Table Of Content

Just keep working hard to save money and don’t forget the 25% rule, and you’ll be in really good shape. Can I just say I love that you’re taking the time to do research like this before deciding to become a homeowner? I always feel so bad for people who buy a house without knowing what they’re getting into and wind up with a huge money mess on their hands.

How much money will be required at closing?

You’ll often hear that you should have three to six months’ worth of living expenses saved to cover emergencies. As a homeowner, you’d be wise to have six months to two years’ worth of living expenses saved. You never know when a global pandemic might wreak havoc on your ability to earn a living and pay for your home. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan.

Mortgage

Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your estimated debt-to-income ratio. If you’re on the market for a $200,000 home, you might find that options in your price range are limited. The national median sale price for a home in July 2023 was more than double that price point at $406,700. Before you make an offer, you’ll also need to make sure you can afford the monthly payments on a $200,000 home. That depends on many factors, including your income, down payment amount and the prevailing mortgage interest rate.

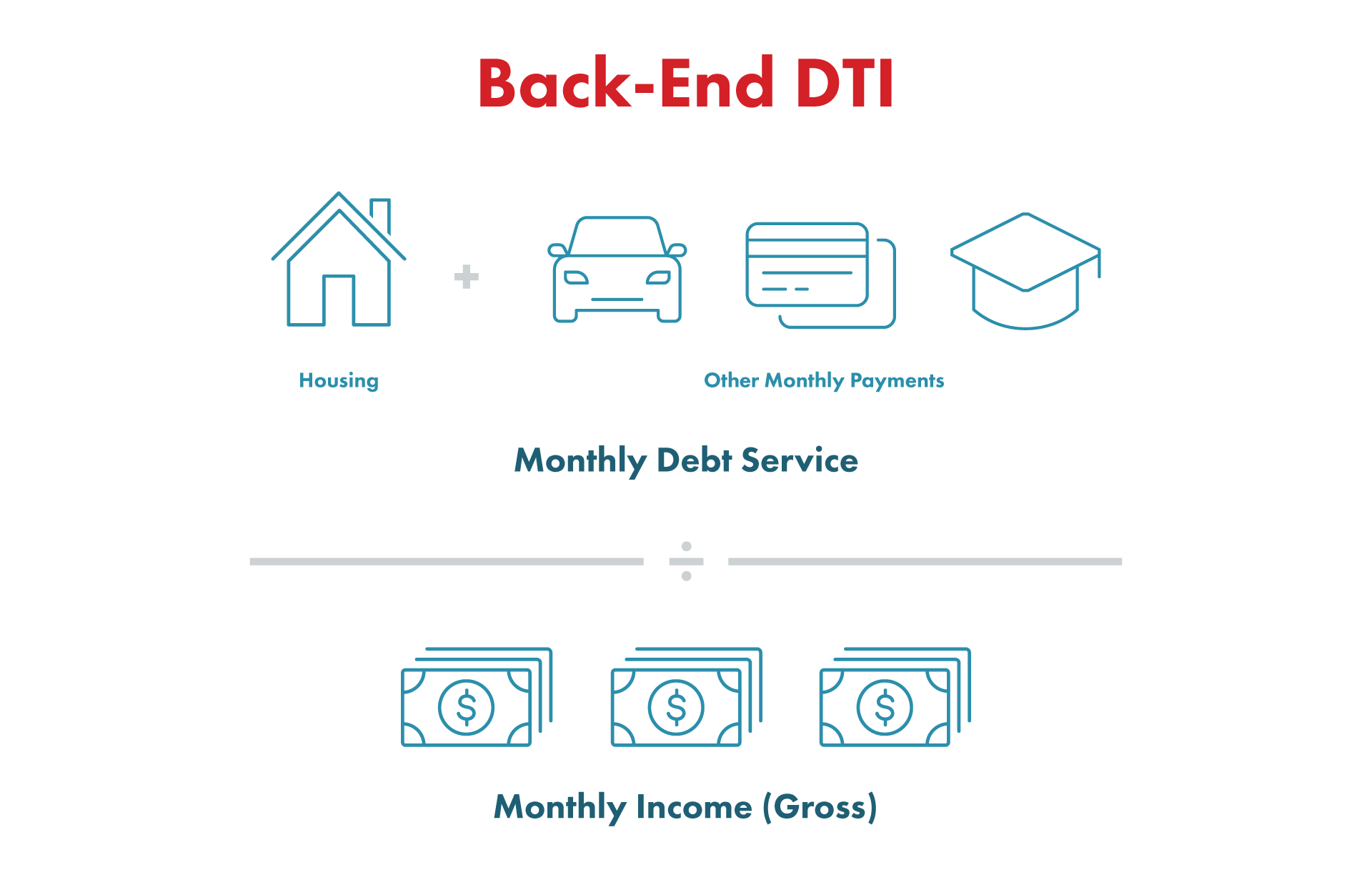

Debt-to-income ratio

The total is divided by 12 months and applied to each monthly mortgage payment. Take stock of your monthly debts besides housing costs, including car payments, credit card bills and student loans, and ensure that the sum doesn’t exceed 36 percent of your income. You want to make sure you can afford life’s basic essentials after your monthly debt obligations are paid. You should also account for the ongoing costs of homeownership, like maintenance and upkeep. Statewide, the findings found that California is also the least affordable state for the average home buyer. According to the data, a median home in California sells for $798,854.

An FHA loan is a mortgage insured by the Federal Housing Administration. Borrowers must pay for mortgage insurance in order to protect lenders from losses in instances of defaults on loans. The insurance allows lenders to offer FHA loans at lower interest rates than usual with more flexible requirements, such as lower down payment as a percentage of the purchase price.

Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment. However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures. PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. Setting aside 28 percent of that amount for housing would equate to $1,092. This figure represents the maximum recommended housing payment for your income level, including principal, interest, property taxes, home insurance premiums and any applicable HOA fees.

Start the mortgage application process with Rocket Mortgage today. Here are answers to a few frequently asked questions about calculating home affordability so you can better understand your buying power. Mortgage term refers to the length of time you have to pay back the amount you’ve borrowed. The most common loan terms are 15 and 30 years, but other terms are available. Next up are several factors that can help you figure out the right price range before you hit the pavement looking for a new home. Read on to calculate how much house you can afford and learn what this means for whether you should buy a house.

Calculate your debt-to-income ratio

If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMI’s cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%. Your estimated annual property tax is based on the home purchase price.

They’ll cost 0.17% to 1.86% per year per $100,000 you borrow, or $35 to $372 per month on a $250,000 loan. The higher your credit score, the more house you can afford for the same down payment. A higher credit score will get you a lower interest rate, and the lower your interest rate, the more you can afford to borrow. Let’s say your car payment, credit card payment and student loan payment add up to $1,050 per month.

Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. The mortgage payments assume a 20% down payment, and they include property taxes and home insurance. The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments.

How Much House Can I Afford On A $200K Salary? - Bankrate.com

How Much House Can I Afford On A $200K Salary?.

Posted: Tue, 11 Jul 2023 07:00:00 GMT [source]

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. For more on the types of mortgage loans, see How to Choose the Best Mortgage. You’ll have a comfortable cushion to cover things like food, entertainment and vacations.

Some homeowners are also affected by what's known as the mortgage lock-in effect. While 54% of baby boomer homeowners own their homes free and clear, according to Redfin, most of those with mortgages have low rates. So it doesn't make much sense to take out a new mortgage, with rates now around 7%.

To find a financial advisor who serves your area, try SmartAsset's free online matching tool. Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

The reason that FHA loans can be offered to riskier clients is the required upfront payment of mortgage insurance premiums. The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household's risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans.

So don’t feel like you’re stuck with the rate of the first lender you meet. Many lenders use this ratio to determine if you can afford a conventional home loan without putting a strain on your finances or causing you to go into default. The 28/36 rule also protects borrowers as much as it protects lenders, as you’re less likely to lose your home to foreclosure by overspending on a home. Depending upon your property location, property type, and loan amount, you may have other monthly or annual expenses such as mortgage insurance, flood insurance, or homeowner association fees. In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios (DTI), albeit slightly different and explained below.

No comments:

Post a Comment